CAR CATALYST OF THE WEEK & TIP OF THE WEEK

This week we present the KIA & HYUNDAI Auto cat. serial #MCD

Data

- Car Private

- Brand KIA & HYUNDAI

- Ref MCD

Note: Please consider that the PGM (Pt, Pd, Rh) content might change from one catalytic to another (with the same serial #) due to its condition affected by mileage, weather conditions, etc. *Assay made with Niton XLT3GOLDD+

PRICE COMPARISON IN DIFFERENT APPS

TIP OF THE WEEK

Investing In Physical Gold vs. Physical Silver

Investing in gold and silver can be an excellent way to diversify your portfolio and hedge against economic uncertainty. Both gold and silver are popular investments and have been used as a store of value for thousands of years.

There are many articles discussing the different factors that affect the prices of gold and silver, such as: other commodities (oil), inflation rate, US dollar, interest rates, stock market, geopolitical situation, etc. There is also vast information on the different ways of owning gold & silver, such as: physical, ETFs, stocks, tokens backed by physical metal (T-gold & T-silver), etc.

Let us focus today on physical gold and silver investment:

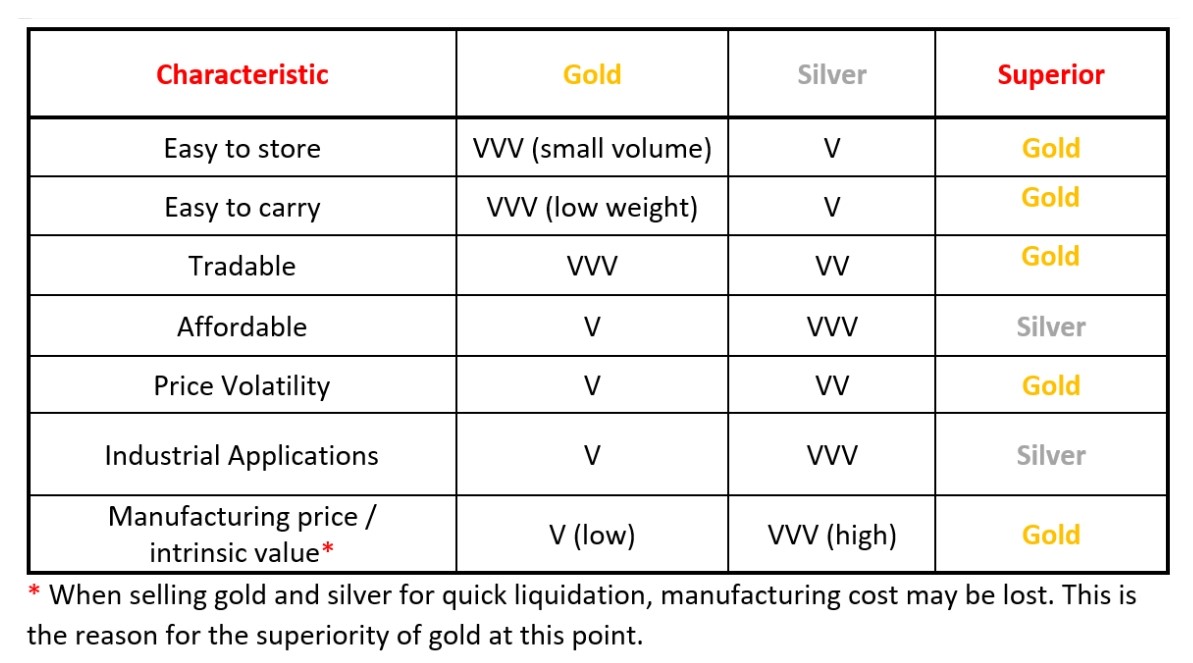

The table below gives short comparison of a few important characteristics of physical gold & silver bullions when considering investments.

Conclusion: From a glance at this table, it seems that gold has priority over silver, but this is a personal decision.

A.G. Metals

Ami Gur