The Precious Metals Market: An Insightful Look at the World’s Most Valuable Commodities

For thousands of years, precious metals have been valued for their beauty, rarity, and practical applications. Gold, silver, platinum, and palladium have all played important roles in the global economy, and each metal has its own unique characteristics and uses.

The precious metals are a group of 8 metals with common physical and chemical properties. In this article we will focus on the four metals which are most known to the general public:gold, silver, platinum and palladium. The other four, which are less known, are iridium, ruthenium, rhodium and osmium.

Gold is perhaps the most well-known precious metal, and for good reason. Gold has been used as a form of currency for centuries, and its value has remained relatively stable over time. This is due in part to the limited supply of gold, which cannot be created or manufactured. Gold is also highly prized for its aesthetic qualities and is frequently used in jewelry.

But gold is not just a decorative metal. Gold is also used in a number of industrial and technological applications. Gold is an excellent conductor of electricity and does not corrode, making it an ideal material for electronic components. Gold is also biocompatible and is used in medical implants and diagnostic equipment.

The price of gold is affected by a number of factors, including global economic conditions, political instability, and inflation. Recently, gold prices have risen due to uncertainty in the global economy caused by the COVID-19 pandemic. As investors seek out safe-haven assets, gold has become an attractive option for many.

Silver is another valuable precious metal, with a long history of use in jewelry and silverware. In addition to its decorative uses, silver is also used in the photography, electrical, and medical industries. Silver is an excellent conductor of electricity and is frequently used in electrical switches and contacts.

But silver is perhaps best known for its use in the solar panel industry. As demand for renewable energy sources has increased, so too has the demand for silver. In fact, the solar industry now accounts for approximately 10% of global silver demand. This has driven up the price of silver in recent years, making it an attractive investment option for many.

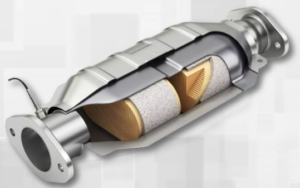

Platinum is a highly valued precious metal, known for its durability and resistance to corrosion. It is used in the jewelry industry, as well as in catalytic converters for automobiles and in the production of computer hard drives.

The price of platinum is affected by a number of factors, including the supply of the metal, the demand for automobiles, and global economic conditions. Recently, the price of platinum has been impacted by the shift towards electric cars, which do not require catalytic converters. This has led to a decrease in demand for platinum, which has in turn caused prices to fall.

Palladium is another valuable precious metal, with a similar appearance to platinum. It is used primarily in the automobile industry, where it is used in catalytic converters to reduce emissions.

The price of palladium is affected by supply and demand, as well as the price of platinum. Recently, the price of palladium has risen due to a shortage of supply, caused in part by political instability in Russia, one of the world’s largest producers of the metal.

Investing in precious metals can be a good way to diversify a portfolio and protect against inflation. Gold, silver, platinum, and palladium are all valuable commodities with practical applications in a variety of industries. However, each metal has its own unique characteristics and price drivers, and investors should carefully consider their options before investing.

In addition to their practical uses, precious metals also have a long and fascinating history. Gold, for example, has been valued by cultures all around the world for thousands of years. The ancient Egyptians used gold to decorate the tombs of pharaohs, while the Greeks and Romans used gold coins as a form of currency. Today, gold continues to be a symbol of wealth and prosperity, and is often used as a store of value during times of economic uncertainty.

Silver also has a long and rich history, and has been used for both practical and decorative purposes for thousands of years. In the Middle Ages, silver was used as a form of currency, and the phrase “born with a silver spoon in his mouth” was used to describe someone who was born into wealth. Silver has also been used to make beautiful and intricate jewelry and silverware, and has played a role in many cultural traditions around the world.

Platinum and palladium, on the other hand, are relatively recent additions to the world of precious metals. Platinum was first discovered in the 18th century and quickly became popular for use in jewelry. In the 20th century, platinum became increasingly important for industrial applications, particularly in the automotive industry.

Palladium was not discovered until the 19th century and was not widely used until the mid-20th century. Today, palladium is primarily used in the automotive industry, where it is used in catalytic converters to reduce emissions. Palladium is also widely used in electronic capacitors

and Industrial catalysts.

Despite their differences, all four precious metals have one thing in common: they are all relatively rare and valuable. This has led to a booming market for precious metals, with investors around the world buying and selling gold, silver, platinum, and palladium in the hopes of turning a profit.

Investing in precious metals can be a good way to diversify a portfolio and protect against inflation. However, it is important to remember that investing in precious metals is not without risk. The price of precious metals can be volatile, and changes in global economic conditions, political instability, and technological advancements can all have an impact on prices.

In addition to investing in physical precious metals, investors can also invest in exchange-traded funds (ETFs) that track the prices of gold, silver, platinum, and palladium. This can be a good way to gain exposure to the precious metals market without having to purchase physical metals.

Whether you are an investor looking to diversify your portfolio, a jewelry enthusiast looking to add to your collection, or simply someone interested in the fascinating history and uses of precious metals, gold, silver, platinum, and palladium all offer something unique and valuable.

When it comes to buying and selling precious metals, it is important to understand the different factors that can impact their prices. One of the most important factors is supply and demand. As these metals are relatively rare, any changes in supply, such as the discovery of a new mine or a disruption in production, can have a significant impact on prices.

Another factor to consider is economic and political stability. When there is uncertainty in the global economy, such as during a recession or a geopolitical crisis, investors tend to flock to precious metals as a safe haven. This can drive up demand and prices.

In addition, changes in technology can also impact the precious metals market. For example, the increasing popularity of electric vehicles could have an impact on the demand for platinum and palladium, as these metals are used in catalytic converters for traditional gas-powered cars.

When it comes to investing in precious metals, it is important to do your research and work with a reputable dealer. Physical precious metals should be stored in a secure location, such as a safe or a bank vault, to protect against theft. It is also important to keep accurate records of all transactions and to be aware of any tax implications.

In addition to their value as investments, precious metals also have a rich cultural history and significance. For example, gold has been used in religious and cultural ceremonies around the world for thousands of years. The Aztecs, for example, believed that gold was the sweat of the sun, and used it to make intricate jewelry and decorative objects.

Silver has also played an important role in many cultures throughout history. In ancient Greece and Rome, silver was used as currency, and silver coins were often used as a symbol of wealth and power. In traditional Chinese culture, silver was believed to have healing properties and was used to create ornate decorative objects.

Platinum and palladium may be more recent additions to the world of precious metals, but they also have their own unique significance. Platinum is often associated with luxury and exclusivity, and has been used to create some of the most expensive and coveted jewelry in the world. Palladium, on the other hand, is a more affordable alternative to platinum and has become increasingly popular for use in wedding rings and other types of jewelry.

In conclusion, precious metals such as gold, silver, platinum, and palladium have captivated human beings for thousands of years. Whether you are an investor looking to diversify your portfolio, a collector interested in the history and significance of these metals, or simply someone who appreciates their beauty and value, there is no denying the enduring appeal of these precious materials. By understanding the market factors that can impact their prices and working with a reputable dealer, investors can enjoy the potential benefits of investing in precious metals while also appreciating their cultural and historical significance.