CAR CATALYST OF THE WEEK & TIP OF THE WEEK

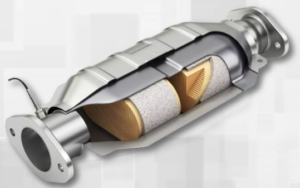

This week we present the Ford Mondeo Auto cat. serial #3110245400,

And a tip -Understanding the Intrinsic Value of Gold vs. Silver

Data

- Car Private

- Brand Ford

- Ref 3110245400

Note: Please consider that the PGM (Pt, Pd, Rh) content might change from one catalytic to another (with the same serial #) due to its condition affected by mileage, weather conditions, etc. *Assay made with Niton XLT3GOLDD+

PRICE COMPARISON IN DIFFERENT APPS

TIP OF THE WEEK

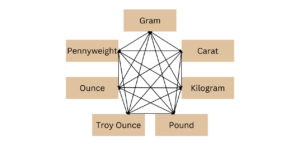

Understanding the Intrinsic Value of Gold vs. Silver

In the world of precious metals, understanding the intrinsic value of gold and silver is paramount. Here’s a quick tip to grasp the essentials:

Gold-Silver Ratio (GSR): Remember, the GSR indicates the value relationship between gold and silver. With a current ratio of around 80, gold holds significantly higher value compared to silver in the market.

Coin Pricing Dynamics: When it comes to bullion coins, the pricing dynamics differ. Silver coins often carry higher premiums, around 40% above the spot price, while gold coins command lower premiums, typically around 5%.

Cash-in Considerations: In situations requiring quick liquidation, like cashing in coins or bars, remember that gold’s superior intrinsic value shines. You’re more likely to receive spot prices, where gold’s lower percentage premium translates to better returns.

Understanding these dynamics empowers you to make informed decisions in the precious metals market. Keep an eye on the GSR and consider the intrinsic value when planning your investment strategy.

For our YouTube video on this issue press Intrinsic

A.G. Metals

Ami Gur