Silver Surge: Navigating Investment Opportunities in 2024

As we step into 2024, silver investors are greeted with a landscape that continues to offer promising opportunities. The dynamics of the silver market have been evolving, presenting both challenges and prospects for those keen on investing in this precious metal. Here are key facts to consider for silver investment in the year ahead:

1. Persistent Supply-Demand Imbalance: In 2023, for the third consecutive year, the demand for silver surpassed its available supply. This trend underscores the sustained appetite for silver across various sectors, indicating its enduring value and utility.

2. Record Industrial Demand: Industrial consumption of silver soared to new heights in 2023, reaching a staggering 654.4 million

ounces. This surge was driven by the growing adoption of silver in diverse industrial applications, particularly in the rapidly expanding renewable energy sector.

3. Structural Deficit: The silver market experienced a significant structural deficit of 184.3 million ounces in 2023. This deficit highlights the inherent imbalance between supply and demand, a trend that is expected to persist and even intensify in the coming years.

4. Green Technology Fueling Demand: The proliferation of green technologies, such as solar energy, has been a major catalyst for increased silver demand. Higher-than-anticipated capacity additions in photovoltaic (PV) installations, coupled with the accelerated adoption of next-generation solar cells, have substantially boosted demand from the electrical and electronics sector. Additionally, initiatives in power grid construction and automotive electrification further contribute to the growing appetite for silver.

5. Role of Physical Investment: Physical investment remains a

significant driver of silver demand, constituting approximately 25-30% of the overall demand. This highlights the enduring appeal of silver as a tangible asset and a hedge against economic uncertainty.

6. Projected Market Shortfall: If current trends persist, 2024 is poised to witness another substantial market shortfall, estimated at around 215 million ounces. This would mark the second-largest deficit in the silver market in over two decades, underscoring the persistent imbalance between supply and demand.

7. Resilience Amidst Sectoral Shifts: Despite a notable decline in demand from the silverware and jewelry sectors between 2022 and 2023, the overall deficit remained largely unaffected. This resilience underscores the diversified nature of silver demand, with industrial and technological applications playing an increasingly dominant role.

In light of these factors, silver continues to present compelling investment opportunities in 2024 and beyond. As the global economy transitions towards sustainability and green technologies, the demand for silver is poised to escalate, driven by its essential role in various cutting-edge applications. For investors seeking to capitalize on this trend, a strategic allocation to silver within a well-diversified portfolio could prove to be a prudent long-term investment strategy. However, it’s essential to remain vigilant and stay abreast of evolving market dynamics to navigate the complexities of the silver market effectively.

President Trump 1 Oz Silver Round

Donald Trump: 45th President, Now Available in Beautiful .999 Pure Silver Donald Trump will go down as one of the most iconic presidents in American

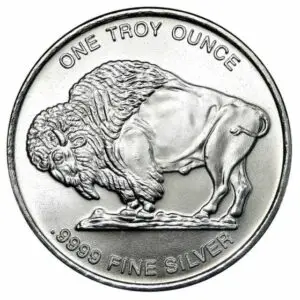

1 Oz Silver Buffalo Round

1 Oz Buffalo Silver Rounds One of the most beautiful coins in US history, the Buffalo nickel remains very popular among numismatists. Nowadays, numerous

Silver American Eagle

Silver American Eagle – RANDOM Year Buy Random Year American Silver Eagle and Save On The Most Popular Coin in the World! World’s most