Understanding the Decline in Palladium Prices

Introduction

Palladium, a precious metal predominantly used in automotive catalytic converters, has seen a dramatic price drop from about $2800 per ounce in February 2022 to around $1000 per ounce in May 2024. This ongoing decline introduces significant uncertainty and risk across the entire autocatalytic recycling chain—from shops and dealers up to the refiners.

Thrifting in the Automotive Industry

One of the primary drivers of the decrease in palladium demand is the process known as “thrifting.” Automotive manufacturers are increasingly substituting palladium with platinum in catalytic converters. This shift is primarily due to the lower cost of platinum compared to palladium, making it a more economically viable option without compromising the effectiveness of emissions control.

The Rise of Electric Vehicles

The automotive landscape is undergoing a transformation with the rise of electric vehicles (EVs), which do not require catalytic converters. Since catalytic converters are the main application of palladium in vehicles, the growth in EV adoption directly impacts the demand for palladium. As more consumers and governments push towards greener alternatives, the shift away from internal combustion engines is expected to further reduce palladium usage.

Macro Economic Factors

The decline in palladium prices is exacerbated by global economic slowdown and higher interest rates. Slower economic growth translates to reduced vehicle sales, subsequently lowering the demand for palladium. Additionally, high interest rates and the increased lease price of metals during this period have diminished the appeal of investing in precious metals, which are non-yielding assets.

Impact on the Supply Chain

The dramatic decline in palladium prices poses considerable risks and uncertainty for all stakeholders in the autocatalytic recycling chain. The volatility affects shops, dealers, and refiners who rely on stable palladium prices to forecast costs and revenues effectively. As the main metal used in catalytic converters, any fluctuation in palladium prices significantly impacts the economics of recycling these components.

Conclusion

The multifaceted decline in palladium prices, influenced by industrial innovation, economic conditions, and shifts in consumer behavior towards sustainable alternatives, underscores the complex dynamics of the precious metals market. Stakeholders must navigate these challenges with informed strategies to mitigate risks associated with such volatile market conditions.

President Trump 1 Oz Silver Round

Donald Trump: 45th President, Now Available in Beautiful .999 Pure Silver Donald Trump will go down as one of the most iconic presidents in American

2024 Gold American Eagle Coin – 1 Troy Ounce, 22k Purity

. 2024 Gold American Eagle Coin – 1 Troy Ounce, 22k Purity Highly popular American Eagle gold coin series in the 1 oz gold bullion size,

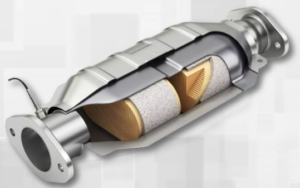

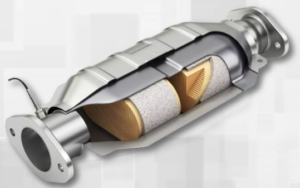

Car Catalytic Converter Value Calculator imperial

This calculator, designed to calculate the catalytic converters precious metals value, based on precious metals assay of the monolith.