Unveiling the Intrinsic Value: Gold vs. Silver in the Precious Metals Market

In the realm of investments, few assets hold the allure and time-tested value of precious metals. Among these, gold and silver stand out as perennial favorites, coveted for their intrinsic worth and historical significance. However, understanding the nuanced differences in their intrinsic values is essential for informed decision-making in the bullion market.

At the heart of this understanding lies the Gold-Silver Ratio (GSR), a fundamental indicator that illuminates the relationship between the two metals’ values. Currently hovering around 80, the GSR signifies that the value of gold is approximately 80 times that of silver in the market. This ratio serves as a crucial benchmark for investors, guiding their allocation strategies and highlighting potential market imbalances.

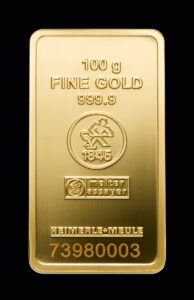

When delving into the dynamics of bullion coins, another layer of complexity emerges. Silver coins, such as the iconic American Eagle, often carry premiums well above the spot price, typically around 40%. This premium reflects not only the intrinsic value of the silver but also factors like minting costs and market demand. In contrast, gold coins command lower premiums, typically around 5% above the spot price. This stark difference underscores the disparity in intrinsic values between gold and silver.

The implications of these pricing dynamics become particularly

evident when considering liquidation scenarios. In situations necessitating swift cash-ins, such as emergencies or sudden financial needs, the intrinsic value of precious metals takes center stage. Here, gold’s superiority shines through. When selling gold coins or bars, investors are more likely to receive spot prices, where the lower percentage premium translates to more favorable returns. In contrast, the higher premiums associated with silver can erode potential profits, highlighting the importance of strategic planning and asset allocation.

Armed with this knowledge, investors can navigate the bullion market with confidence, leveraging insights into the intrinsic value of gold and silver to optimize their portfolios. By monitoring the GSR and staying attuned to market dynamics, they can capitalize on opportunities, mitigate risks, and preserve wealth in an ever-changing economic landscape.

In conclusion, the intrinsic value of gold and silver serves as the bedrock of their enduring appeal in the investment world. While both metals offer unique benefits and diversification opportunities, understanding their nuances is paramount for success. By embracing the insights provided by the GSR and pricing dynamics, investors can unlock the full potential of precious metals in their wealth preservation strategies.

Disclaimer

Disclaimer! The content provided on this website is for informational purposes only and is not intended to be a substitute for professional or financial advice.

Understanding the Decline in Palladium Prices

INTERESTING POSSIBILITES BY GOLD with CRYPTO-WOW!!! Understanding the Decline in Palladium Prices Introduction Palladium, a precious metal predominantly used in automotive catalytic converters, has seen

Understanding the Gold Karat System

INTERESTING POSSIBILITES BY GOLD with CRYPTO-WOW!!! Understanding the Gold Karat System: History, Percentages, and Stamping Gold has been a symbol of wealth and beauty

Eddy Current Testing for Authenticating Gold and Silver

Advanced Metal Verification: Eddy Current Testing for Authenticating Gold and Silver IntroductionEddy current testing stands as a non-destructive technique crucial for verifying the authenticity of

GQ GMC-800 Nuclear Radiation Detector USA Design

GQ GMC-800 Nuclear Radiation Detector USA Design Product US National StandardGreat affortable detectoer – for more info press MORE

SE International MONITOR 200 Compact Radiation Detector

SE International MONITOR 200 Compact Radiation Detector Monitor 200 The Monitor 200, your go-to solution for precise and versatile radiation detection. This state-of -the-art device