Securing Your Wealth: The Essential Guide to Investing in Physical Gold

Welcome to our website! My name is Ami Gur, the proud founder of A. G. Metals. With a rich background in Materials Engineering and over three decades of expertise in the precious metals industry—spanning manufacturing, trading, and recycling—I have cultivated a deep and abiding connection with these invaluable resources. Since my university days in the late 1980s, precious metals have captivated my imagination, intertwining with the very essence of my being.

In this article, I aim to distill my years of experience and passion into insights about investing in physical gold. We will navigate through this topic by addressing seven crucial questions, providing you with a comprehensive understanding and actionable knowledge:

- Why Invest in Physical Gold?

Explore the timeless allure of gold as a store of wealth, a hedge against inflation, and its role in diversifying investment portfolios. - How Much to Invest in Physical Gold?

Delve into strategies for determining the optimal allocation of gold in your investment portfolio, considering factors such as risk tolerance and financial goals. - When to invest in phsical gold Understand the significance of timing in gold investment, and why a long-term, disciplined approach often trumps attempting to time the market.

- In What Form to Invest in Physical Gold (Bars, Coins, Sizes)?

Learn about the advantages and considerations of different forms of gold, from bars to coins, and the importance of size in maximizing value and liquidity. - Where to Buy Physical Gold?

Discover the importance of purchasing gold from reputable sources, ensuring authenticity, and the benefits of dealers who offer buyback policies and investment guidance. - Where to Store & Ensure Physical Gold?

Considerations for the safekeeping and insurance of your gold investments, exploring options from home safes to vault services. - What Are the Downsides of Investing in Physical Gold?

A candid look at the potential challenges and considerations of gold investment, including liquidity issues, storage costs, and market volatility.

Through this exploration, I aim to equip you with the knowledge and confidence to make informed decisions about investing in physical gold. Join me as we delve into the world of precious metals, where wealth preservation and investment strategy meet the luster and legacy of gold.

Background

The Golden Anchor: Understanding the Role of Physical Gold in Investment Portfolios

In the intricate world of investment, where assets fluctuate with the mercurial moods of markets, physical gold stands as a beacon of stability and security. Unlike the ephemeral nature of stocks and bonds, which can vanish in the whirlwind of a market crash, gold retains its value, embodying the essence of wealth for millennia. This enduring allure of gold is not merely a relic of ancient times but a cornerstone for modern investment strategies, offering a tangible asset that can anchor portfolios against the stormy seas of financial uncertainty.

The intrinsic value of physical gold, beyond its glittering appearance, lies in its scarcity and the universal esteem it commands across cultures and economies. Unlike paper currency, whose value is subject to the whims of governmental policies and inflationary pressures, gold’s worth is intrinsic, offering a bulwark against the erosion of wealth. This makes gold a critical diversification tool for investors, acting as a counterbalance to the volatility of other assets.

Physical gold’s role in investment portfolios transcends mere diversification. It is a symbol of wealth preservation that has withstood the test of time. In times of economic instability or inflation, investors flock to gold as a safe haven, driving up its value when other assets are faltering. This counter-cyclical nature makes gold a unique asset, capable of providing insulation against both inflation and deflation.

Moreover, the tangible nature of physical gold offers a psychological comfort that paper assets cannot. Holding gold, feeling its weight, and seeing its luster instill a sense of security and permanence. It’s not just an entry in a ledger or a figure on a screen; it’s a real, unchangeable asset that can be passed down through generations, preserving wealth beyond the lifespan of any single investor.

There are many ways to invest in gold from physical. Mining stocks, gold exchange-trade funds (ETF), futures, digital tokens and more, searching google for gold gives more results then searching “God”, so there is an infinite information on the Gold.

Lets Focus

In the below article we will try to present the key point for investing in physical Gold in an accurate, objective and cosine manor, we add some links to those who are looking for deeper understanding and angels, we also add some basic terms list for related to gold investment.

why to invest in physical gold

Wealth Preservation: Gold’s enduring value has made it a reliable asset for preserving wealth through time.

Hedge Against Inflation: Historically, gold’s value increases with the cost of living, protecting against the erosion of purchasing power.

Safe Haven During Economic Uncertainty: Gold is sought after in times of economic trouble, often rising in value when other investments falter.

Diversification: It offers balance to investment portfolios, often moving inversely to stock markets and currencies.(this is a key factor).

Finite Resource: The scarcity of gold, due to limited supply and challenging extraction processes, supports its demand and long-term value. (about 200 000 tone above ground

And about 50000 tons below ground)

Liquidity: Gold’s global acceptance ensures it is one of the most liquid investments available. (Gold can cashed almost everywhere on earth)

No Credit Risk: Gold carries no credit risk, offering a stable asset independent of any issuer’s financial performance.

Privacy: Physical gold investments can be private, offering an alternative to digitally tracked assets.

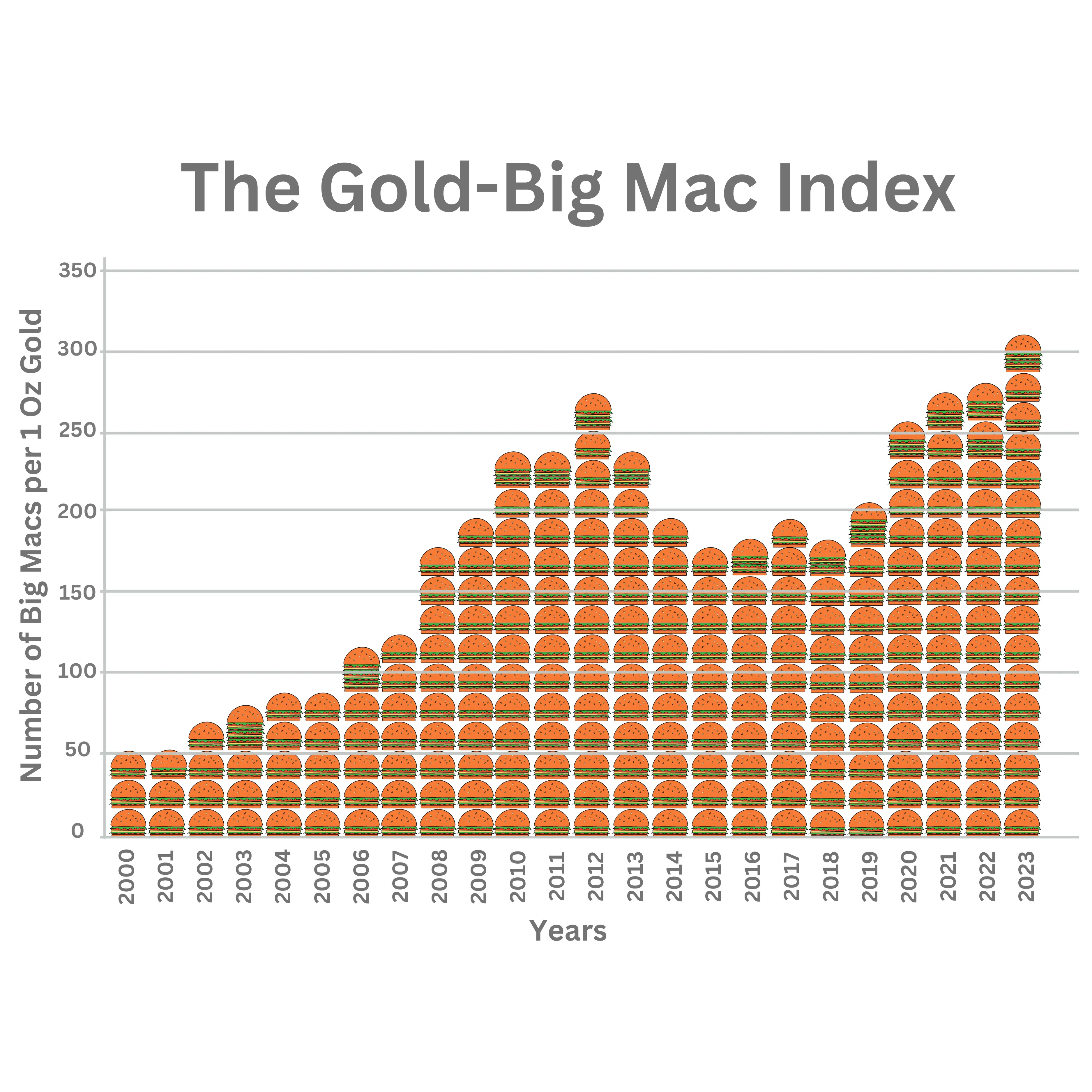

Protection Against Currency Devaluation: Gold’s price tends to rise when currencies weaken, offering protection against devaluation. ( Just for fun …in the year 2000 you could buy in the US about 60 Big Mac Burgers with one ounce of gold, in 2022 in jumped to over 300 burgers !)

Tangible Asset with Universal Appeal: Gold is both a precious metal and a form of currency, not controlled by any country, making it universally appealing.

Critical for Technology and Industry: Gold is indispensable in various technological applications. Its superior electrical conductivity, resistance to corrosion, and excellent thermal conductivity make it critical in manufacturing numerous devices, including cell phones, computers, airbags, and night vision devices. The demand for gold in these applications adds another layer of value, reinforcing its importance not just as an investment or decorative item but as a key component in modern technology and industry.

These reasons collectively underscore gold’s multifaceted value, offering a compelling case for its inclusion in diverse investment portfolios. Beyond its historical and economic significance, gold’s role in technology and industry highlights its indispensability in modern society, further cementing its status as a critical asset for investors and industries alike.

And one more point: If central banks of USA Chaina Russia Germany Turkey and more

Still in 2023 increase there Gold reserve might be they understand something!!!!!!!!!

How much to invest in Physical Gold

The recommendation on how much to invest in physical gold can vary depending on an individual’s financial situation, investment goals, and risk tolerance. Financial advisors often suggest a diversified portfolio to mitigate risk, and within that framework, gold can play a crucial role due to its unique properties, including acting as a hedge against inflation and economic uncertainty. Here are some general guidelines:

Percentage of Portfolio

Conservative Estimates generally recommend allocating 5% to 10% of your investment portfolio to gold or other precious metals. This conservative approach is aimed at diversification and protection without overexposure to the volatility of gold prices.

More Aggressive Strategies might suggest increasing the allocation to 10% to 20% for those particularly concerned about severe economic downturns, currency devaluation, or hyperinflation. This higher allocation is based on gold’s historical performance during times of financial crisis.

Factors to Consider

Risk Tolerance: Investors with a lower risk tolerance may lean towards the lower end of the recommended allocation, viewing gold as a stable, albeit less growth-oriented, asset. Those with a higher risk tolerance and a focus on long-term growth might allocate less to gold, favoring assets with higher growth potential.

Economic Outlook: Your outlook on the global economic situation can influence your decision. In times of increased economic instability, raising your investment in gold might seem more appealing due to its safe-haven status.

Investment Goals: Consider your investment goals, such as retirement savings, wealth preservation, or speculation. Gold’s role as a conservative investment for wealth preservation might warrant a higher allocation for those nearing retirement compared to younger investors with a longer time horizon.

Market Conditions: The current and anticipated conditions of the gold market should influence your decision. Entry points, or the price levels at which you buy, can affect the ideal amount of gold to hold.

Adjusting Over Time

Review and Adjust: Like any investment strategy, your allocation to gold should be reviewed periodically and adjusted based on changes in your financial situation, investment goals, and the economic landscape.

Balance and Rebalance: As the market value of gold changes, so will its proportion in your portfolio. Regular rebalancing is essential to maintain your desired allocation percentage and risk level.

Professional Advice

Given the complexities involved in investment decisions, consulting with a financial advisor or investment professional is highly recommended. They can provide personalized advice based on the latest market conditions, your financial situation, and your long-term financial goals, ensuring that your investment in gold aligns with your overall investment strategy

When to invest in physical Gold

My personal perspective on investing in physical gold as part of a long-term, ongoing diversification strategy, rather than attempting to time the market, aligns well with the views of many financial experts and seasoned investors. Indeed, the unpredictability of markets and economic conditions makes it challenging to identify the “best” time to invest in gold or any asset. Here’s why adopting a continuous investment approach in gold for diversification and long-term holding can be wise:

Dollar-Cost Averaging

Dollar-cost averaging involves regularly investing a fixed amount of money in an asset, such as gold, regardless of its price at any given time. This strategy can help mitigate the risk of investing a large amount at an inopportune time when prices might be high. Over time, the cost averages out, potentially lowering the average purchase price per ounce of gold.

Long-term Hedge

Gold’s role as a long-term hedge against inflation and currency devaluation means that its value may not correlate directly with short-term market movements but is more about preserving purchasing power over decades. Regular investments in gold can thus provide a safeguard against the erosion of wealth, especially in uncertain economic times.

Market Timing Challenges

Attempting to time the market is notoriously difficult. Many investors miss out on significant gains by waiting for the “right” moment to invest. The price of gold can be influenced by a myriad of unpredictable factors, including geopolitical events, shifts in monetary policy, and changes in demand. As such, a steady, ongoing investment approach reduces the risks associated with trying to predict future movements.

Diversification Benefits

Continuous investment in gold as part of a broader diversification strategy ensures that your portfolio is not overly reliant on one asset class. Since gold often moves inversely to stocks and other financial instruments, it can provide balance and reduce overall portfolio risk.

Emotional Investing and Market Sentiment

Regular, disciplined investing helps mitigate the impact of emotional decision-making based on short-term market volatility or sentiment. Investors are less likely to make impulsive decisions based on fear or greed, which can adversely affect long-term financial goals.

Starting Sooner Rather Than Later

Beginning your investment in gold sooner rather than later, as part of a consistent strategy, allows more time for your assets to potentially grow and for you to benefit from gold’s stabilizing effects on your portfolio.

Monitoring and Adjusting

While a continuous investment approach is advisable, it’s also important to periodically review and adjust your investment strategy based on changes in your financial situation, investment goals, and the economic landscape. This might mean adjusting how much you invest in gold over time or rebalancing your portfolio to maintain your desired asset allocation.

In what form of physical gold to invest (bars, coins sizes)

Choosing the right form of physical gold to invest in is a crucial decision that balances cost, liquidity, and investment strategy. Your guidelines for selecting gold bullion within the range of one ounce to 500 grams (approximately 16.075 ounces) are well-founded and cater to the needs of the “average” investor by considering both the intrinsic value and practical aspects of liquidity and flexibility. Here’s an expanded view on your approach:

Optimizing for Intrinsic Value:

Lower Premiums Over Spot: Larger gold pieces typically have lower premiums over the spot price of gold compared to smaller pieces. This is because the manufacturing costs, as a percentage of the total cost, are lower for larger items. By opting for bullion within the one ounce to 500 grams range, investors can reduce these premiums, ensuring a higher proportion of their investment is in the gold itself, rather than in associated costs.

Consideration of Manufacturing Costs: Smaller bullion pieces, such as fractional gold coins or tiny bars, carry higher premiums due to the proportionally higher costs of fabrication. Investors looking to maximize the intrinsic value of their holdings would find the suggested size range more cost-effective.

Maintaining Liquidity and Flexibility:

Liquidity Considerations: While larger bars (such as kilo bars) may offer the lowest premiums over spot, they can be less liquid than smaller units. Selling a large bar requires finding a buyer with the capital for such a purchase, which can be limiting. Gold in the one ounce to 500 grams range strikes a balance, being substantial enough to minimize premiums while still being small enough to sell easily.

Flexibility in Selling: Investing in gold bars or coins within this size range allows for greater flexibility. Instead of having to sell a large portion of your investment to access cash, smaller denominations enable you to sell only what you need at the moment, potentially allowing you to retain some of your investment during downturns or capitalize on future price increases.

Practical Considerations:

Portfolio Diversification: By purchasing gold in various sizes within the one ounce to 500 grams range, investors can diversify their holdings even within the gold portion of their portfolio, providing additional flexibility.

Recommendations for “Average” Investors:

Gold Coins: Sovereign coins like the American Eagle, Canadian Maple Leaf, or South African Krugerrand in one ounce sizes are highly recognizable, making them easier to sell. They also offer a blend of collectibility with their intrinsic value.

Gold Bars: Bars from reputable mints and refineries in sizes from one ounce to 500 grams are ideal for investors focusing on the purity and value of gold. They usually have lower premiums than coins and are straightforward in terms of value assessment.

Where to buy Physical Gold

Selecting the right source for purchasing physical gold is as crucial as deciding to invest in gold itself. Given the risks of counterfeit products and the complex nature of gold investments, especially regarding tax implications, buying from reputable, authorized dealers is paramount. Here are key considerations to ensure a safe and strategic gold purchase:

Authorized and Reputable Dealers

Certification and Authorization: Look for dealers who are certified and authorized by recognized industry bodies. Dealers should have verifiable credentials and a strong reputation in the market.

Reviews and Ratings: Check online reviews, ratings, and feedback from other buyers to gauge the dealer’s reliability and service quality. A reputable dealer should have a track record of positive customer experiences.

Buyback Policy

Security and Liquidity: A clear buyback policy provides security and liquidity, ensuring that you can sell your gold back to the dealer if needed. This policy is crucial for your investment’s flexibility and peace of mind.

Terms and Conditions: Understand the terms and conditions of the buyback policy, including any fees, price guarantees, and the process involved. A straightforward and fair buyback policy is a good indicator of a reputable dealer.

Tax and Investment Guidance

Tax Implications: Since gold investments can have various tax implications, it’s important to deal with sellers who can provide guidance or references to experts on how to navigate these issues.

(IRA benfits)

Product Selection: Different forms of gold (coins, bars, bullion) have different tax implications and investment characteristics. A knowledgeable dealer can assist you in choosing the right products that align with your investment goals and tax considerations.

Product Authenticity

Verification: Ensure that the dealer offers verified and certified gold products. Authenticity guarantees, such as certificates of authenticity and secure packaging, are essential.

Testing and Assays: Some dealers provide testing services or products that come with assay certifications, confirming the purity and weight of the gold.

Transparency and Education

Clear Pricing: Prices should be transparent, with clear indications of any premiums, shipping costs, insurance, and handling fees. Avoid dealers with hidden fees or those unwilling to provide clear pricing upfront.

Educational Resources: Reputable dealers often provide educational resources to help investors understand the gold market, investment strategies, and product options. This support can be invaluable, especially for new investors.

Personalized Service

Customer Service: Look for dealers who offer excellent customer service, including personalized advice and support throughout the buying process. The ability to speak directly with knowledgeable staff can be a significant advantage.

Security and Delivery

Secure Transactions: Ensure that the dealer uses secure transaction processes and provides insured shipping for physical delivery. The safety of your investment from purchase to delivery should be a priority.

Where to Store and Insure Physical Gold: Navigating Your Options

Investing in physical gold presents a unique set of considerations, particularly when it comes to storage and insurance. Gold’s tangible nature requires secure and reliable storage solutions, and its value necessitates comprehensive insurance coverage. Here, we explore the various options for storing and insuring physical gold, highlighting the pros and cons of each to help investors make informed decisions.

- Safe at Home with Private Insurance

- Pros:

- Immediate Access: Storing gold at home offers instant access to your investment.

- Privacy: This option ensures complete control and privacy over your assets.

- Cons:

- Security Risks: Home storage exposes you to the risk of theft, requiring robust security measures.

- Higher Insurance Costs: Insuring gold stored at home often comes with higher premiums due to increased risk.

- Private Vault with Optional Insurance

- Pros:

- Enhanced Security: Private vaults provide high-level security features, significantly reducing the risk of theft.

- Insurance Options: You can opt for the vault’s insurance, often at lower premiums, or choose private insurance for added confidence.

- Accessibility: Some private vaults are conveniently located, making it easier to access your gold.

- Cons:

- Cost: While potentially offering lower insurance premiums, vault storage comes with a fee, which varies based on the value and volume of gold stored.

- Accessibility Limitations: Depending on the vault’s location and hours, access to your gold might be more restricted compared to home storage.

- Dealer Vault Services

- Pros:

- Global Accessibility: Some dealers offer vault services that allow you to store gold in various locations worldwide, enhancing accessibility based on your needs.

- Integrated Services: Dealers can offer both buying and storage services, streamlining the process of investing and storing gold.

- Flexibility: The option to move gold through dealer vault services can be advantageous for investors looking to leverage market movements quickly.

- Cons:

- Dependence on Dealer: This option requires reliance on the dealer’s stability and trustworthiness.

- Costs and Fees: There may be additional costs for vault services and potential fees for moving gold between locations.

Tax Considerations

When choosing a storage option, it’s crucial to consider any potential tax benefits or liabilities. Some jurisdictions offer tax advantages for gold stored in certain ways or locations. Consulting with a tax professional can provide clarity on how storage decisions might impact your tax situation.

Conclusion

Deciding where to store and insure physical gold involves balancing security, cost, accessibility, and peace of mind. Home storage offers privacy and immediate access but comes with higher insurance costs and security risks. Private vaults provide enhanced security and potentially lower insurance premiums but at a cost. Dealer vault services offer flexibility and global access but depend on the dealer’s reliability. Tax implications also play a role in this decision, making it important to consider the broader financial landscape. Ultimately, the best choice depends on your individual circumstances, investment strategy, and risk tolerance.

The Downsides of Investing in Physical Gold

While investing in physical gold has its allure and benefits, like any investment, it also comes with certain drawbacks. Understanding these pitfalls is essential for any investor considering adding physical gold to their portfolio. Here are some of the main downsides associated with investing in physical gold:

- No Dividends or Interest

- Unlike stocks or bonds, gold does not generate income through dividends or interest. This lack of passive income means investors solely rely on potential price appreciation for returns, which may not be favorable compared to income-generating assets.

- Storage Costs

- Physical gold requires secure storage to protect it from theft, loss, or damage. Whether stored at home with enhanced security measures or in a professional vault, these storage solutions come with costs that can eat into the investment’s overall returns.

- Insurance Costs

- Given its value and the risk of theft, insuring physical gold is highly advisable. However, insurance premiums can be costly and vary depending on the amount of gold and the chosen storage method, further impacting the investment’s profitability.

- Tax Implications

- Some countries impose taxes on the sale of gold, which can affect the net returns on investment. Capital gains tax is a common consideration, and in some jurisdictions, there may be specific taxes on precious metals that could reduce the investment’s appeal.

- Market Volatility

- While gold is often seen as a safe haven during economic uncertainty, its price can still be volatile. Looking at the gold price chart over the last 100 years reveals periods where the value of gold has decreased significantly against the US dollar, illustrating its susceptibility to fluctuating market forces.

- Liquidity Concerns

- Although gold is generally considered a liquid asset, the ease of converting it to cash can depend on the current market demand and the form of gold invested in (bars, coins, etc.). Larger bars may be more challenging to sell quickly without impacting the price, potentially leading to liquidity issues in urgent situations.

- Opportunity Cost

- Investing a significant portion of assets in physical gold means those funds are not invested elsewhere, such as in the stock market, real estate, or other potentially higher-yielding investments. This opportunity cost, especially over long periods, could result in missed gains.

- Need for Authentication and Appraisal

- Buying and selling physical gold often requires authentication and appraisal to ensure its purity and weight, which can be an additional cost and inconvenience. There’s also the risk of fraud or purchasing counterfeit products, particularly when dealing with less reputable sources.

Conclusion

While physical gold can serve as a valuable component of a diversified investment portfolio, offering potential protection against inflation and economic downturns, it’s important to weigh these benefits against the downsides. The costs associated with storage and insurance, along with its non-income producing nature, tax implications, market volatility, and potential liquidity issues, are critical considerations. As with any investment decision, assessing your financial goals, risk tolerance, and the overall investment landscape is key to determining if gold aligns with your long-term strategy.

Summary Guide on Investing in Physical Gold

Investing in physical gold and silver offers a unique set of opportunities and challenges. Through our exploration of the seven critical questions regarding the “why,” “how much,” “when,” “in what form,” “where to buy,” “where to store and insure,” and “what are the downsides” of investing in these precious metals, we’ve constructed a comprehensive guide for potential investors. Here’s a brief summary emphasizing key points and underscoring the conservative nature of this investment strategy.

Investing in Physical Gold : A Conservative Approach to Diversification

Investment Philosophy: Investing in physical gold and silver should not be seen as a strategy to get rich quickly. Instead, it’s a conservative approach aimed at diversifying one’s investment portfolio. These precious metals can act as a form of insurance policy, providing a safeguard against the volatility of stocks, real estate, and fiat currencies.

The Role of Precious Metals:

- Diversification: Gold and silver add a layer of diversity to investment portfolios, potentially reducing risk by offsetting the volatility of other assets.

- Safe Haven: In times of economic crisis, gold and silver historically have served as reliable stores of value, often appreciating when other investments falter.

Key Considerations for Investors:

- Why Invest?: The primary motivation is not wealth accumulation but wealth preservation, particularly in uncertain economic times.

- How Much to Invest?: Allocation should be based on individual risk tolerance and the desire for portfolio diversification, typically recommended between 5% and 20%.

- When to Invest?: A long-term, disciplined approach, rather than market timing, is advised, using strategies like dollar-cost averaging.

- In What Form?: Options range from bars and coins to ETFs, each with different implications for liquidity, storage, and taxes.

- Where to Buy?: Purchases should be made from reputable dealers to ensure authenticity and fair pricing.

- Storage and Insurance: Secure storage and comprehensive insurance are critical, with options including home safes, private vaults, and dealer storage services.

- Downsides: Investors must consider the lack of income generation, storage and insurance costs, potential liquidity issues, and market volatility.

Forecasting and Personal Decision Making

It’s important to stress that forecasting the future is nearly impossible. The information provided here is intended to be informative and serve as a foundation upon which individual investors can make their own decisions, tailored to their personal situations and risk profiles. Each investor’s approach should reflect their unique circumstances, objectives, and investment philosophy.

Conclusion

While physical gold and silver are not the keys to overnight riches, they offer a time-tested method of protecting wealth, especially in turbulent economic climates. As part of a broader investment strategy, these precious metals can provide stability and security, acting as a counterbalance to the inherent risks of other investment classes. As always, personal research, continuous learning, and sometimes professional advice are essential steps in making informed investment decisions.