Understanding Gold Pricing: Fix, Buy/Sell, and Spot Prices Explained

Gold pricing can be somewhat complex due to the different ways it’s quoted and traded in markets around the world. Understanding the distinctions between “fix” price, “buy” and “sell” prices, and “spot” price is crucial for anyone involved in trading, investing, or purchasing gold. Here’s a breakdown of these terms:

Fix Price

The “fix” price of gold is determined twice daily in the London gold market. The process, known as the London AM fix and the London PM fix, establishes a benchmark gold price used by producers, consumers, investors, and central banks around the world. This fixed price is set through a conference call among major international gold dealers and is based on balancing buy and sell orders at a single moment, providing a snapshot of gold’s market price at those times. It’s used for contracts and provides a standard for valuing gold products and derivatives globally.

Buy and Sell Prices

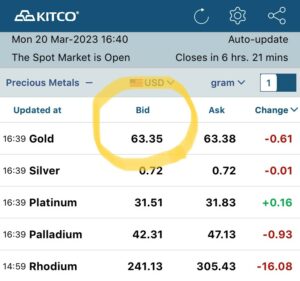

During the trading day, gold is bought and sold in various markets, and each transaction will have a “buy” price (the price a buyer is willing to pay) and a “sell” price (the price a seller is asking). These prices fluctuate throughout the day based on supply and demand dynamics in the market. The difference between the buy and sell price is known as the spread, which can vary depending on the dealer, the volume of gold being traded, and market volatility.

Spot Price

The “spot” price of gold is the current price in the market at which gold can be bought or sold for immediate delivery. It’s constantly changing, based on live trading in futures markets around the world, and reflects the most immediate pricing of gold. The spot price is influenced by various factors, including economic indicators, market speculation, currency values, supply and demand, and buying or selling of gold in the physical and futures markets. Unlike the fix price, which provides a benchmark at specific times, the spot price offers real-time gold value.

In summary, the fix price serves as a benchmark for contracts and valuations, the buy and sell prices represent the transactional prices in the market, and the spot price is the current market price for immediate delivery. Each of these prices plays a crucial role in the global gold market, affecting how gold is traded, invested in, and valued.

Harnessing the Power of Diamond Testers in Precious Metals Scrap Dealing

Harnessing the Power of Diamond Testers in Precious Metals Scrap Dealing In the competitive and intricate world of precious metals scrap dealing, tools that enhance

Professional Diamond Tester

Professional Diamond Tester, Gem Tester Pen Portable Electronic Diamond Tester Tool for Jewelry Jade Ruby Stone About this item This is a

GemOro Auracle Pen Probe

GemOro Auracle Pen Probe | Plug & Play Universal Replacement for AGT1 AGT3 Digital Gold & Platinum Testers | Precision Tool with Expert Professional Reading

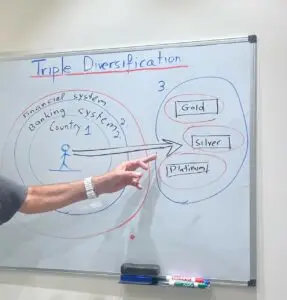

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking In the realm of physical investments, diversifying one’s portfolio is often associated with the acquisition

Electrical Conductivity of Precious Metals

SummaryThis article explores the electrical conductivity of precious metals and their alloys, focusing on its measurement in Siemens per meter and variations across different materials.