Gold vs. Bitcoin: A Comparative Analysis for Long-Term Investment

In the realm of long-term investment, two assets have captured the attention of investors: gold and Bitcoin. While both are often considered stores of value, they exhibit distinct characteristics that make them appealing in different ways. Here, we delve into a comparative analysis of gold and Bitcoin as long-term investment options:

Historical Store of Value:

- Gold: Throughout history, gold has been revered as a reliable store of value. Its intrinsic value, scarcity, and universal acceptance have made it a preferred asset for preserving wealth over centuries.

- Bitcoin: Bitcoin, often hailed as digital gold, has emerged as a new contender in the store of value narrative. Despite its relatively short history compared to gold, Bitcoin has demonstrated resilience and a growing acceptance among investors seeking alternatives to traditional assets.

Scarcity and Supply Dynamics:

- Gold: The supply of gold is limited by nature. While new discoveries and technological advancements have increased its supply over time, the rate of production remains relatively stable, leading to a gradual increase in the overall supply.

- Bitcoin: Bitcoin’s supply is strictly capped at 21 million coins, a feature coded into its protocol. This predetermined scarcity, coupled with the halving events that reduce the rate of new supply, creates a deflationary model that contrasts with traditional fiat currencies and even gold.

Portability and Accessibility:

- Gold: Physical gold, while tangible and universally recognized, lacks the portability and ease of transfer associated with digital assets. Storing and securing large quantities of gold can be cumbersome and costly, particularly for individual investors.

- Bitcoin: As a digital asset, Bitcoin offers unparalleled portability and accessibility. Investors can transfer large sums of Bitcoin across borders with minimal friction and without the need for intermediaries. This characteristic enhances its appeal in an increasingly interconnected global economy.

Volatility and Risk:

- Gold: Historically, gold has exhibited relatively lower volatility compared to many other assets. While its price can experience fluctuations in response to economic and geopolitical events, gold’s long-term stability has made it a preferred hedge against inflation and market uncertainty.

- Bitcoin: Bitcoin’s price volatility is well-documented, with sharp fluctuations occurring over short periods. While this volatility presents opportunities for profit, it also introduces higher levels of risk compared to more established assets like gold. Investors considering Bitcoin must be prepared for price swings and adopt risk management strategies accordingly.

Adoption and Institutional Acceptance:

- Gold: Gold enjoys widespread acceptance and recognition among institutional investors, central banks, and governments. Its status as a safe haven asset and a component of diversified investment portfolios lends it credibility and stability in the eyes of traditional investors.

- Bitcoin: While Bitcoin has made significant strides in terms of adoption and acceptance, particularly among retail and institutional investors, its status as a legitimate asset class is still evolving. Regulatory uncertainty, security concerns, and perceptions of volatility have hindered broader institutional adoption, although initiatives like Bitcoin ETFs and institutional custody solutions are gradually addressing these barriers.

In conclusion, both gold and Bitcoin offer distinct advantages and considerations as long-term investment options. Gold’s historical precedence, stability, and institutional acceptance make it a reliable choice for conservative investors seeking wealth preservation. On the other hand, Bitcoin’s digital nature, scarcity, and potential for outsized returns appeal to those with a higher risk tolerance and a long-term bullish outlook on cryptocurrency. Ultimately, the decision between gold and Bitcoin hinges on individual risk preferences, investment objectives, and convictions about the future of finance.

One more point:

Warren Buffett, renowned for his value investing philosophy, has been a vocal critic of Bitcoin and cryptocurrencies, characterizing them as speculative assets rather than value-producing investments. In his view, the meteoric rise of cryptocurrencies has fueled what he perceives as an “explosion of gambling” rather than genuine wealth creation. Buffett’s skepticism towards Bitcoin is evident in his assertion that its value cannot be accurately assessed due to its lack of intrinsic worth as a value-producing asset.

According to Buffett, investing in Bitcoin or other cryptocurrencies is akin to betting on investor sentiment, with the hope that the next buyer will be willing to pay a higher price. This sentiment contrasts sharply with Buffett’s preferred investment strategy, which focuses on identifying undervalued assets with strong fundamentals and the potential to generate sustainable returns over the long term.

Buffett’s skepticism towards Bitcoin is further underscored by his comparison of the cryptocurrency to gold. While Buffett acknowledges the allure of gold as a store of value, he points out that its intrinsic worth is limited compared to productive assets like farmland and companies such as Exxon Mobil. In Buffett’s view, the tangible value derived from owning productive assets far outweighs the allure of a non-producing asset like gold or Bitcoin.

Ultimately, Buffett’s stance on Bitcoin and cryptocurrencies reflects his conservative approach to investing, which prioritizes fundamental analysis and the pursuit of enduring value. While his views may diverge from those of crypto enthusiasts, Buffett’s track record as one of the most successful investors of all time lends weight to his cautious perspective on speculative assets like Bitcoin.

Harnessing the Power of Diamond Testers in Precious Metals Scrap Dealing

Harnessing the Power of Diamond Testers in Precious Metals Scrap Dealing In the competitive and intricate world of precious metals scrap dealing, tools that enhance

Professional Diamond Tester

Professional Diamond Tester, Gem Tester Pen Portable Electronic Diamond Tester Tool for Jewelry Jade Ruby Stone About this item This is a

GemOro Auracle Pen Probe

GemOro Auracle Pen Probe | Plug & Play Universal Replacement for AGT1 AGT3 Digital Gold & Platinum Testers | Precision Tool with Expert Professional Reading

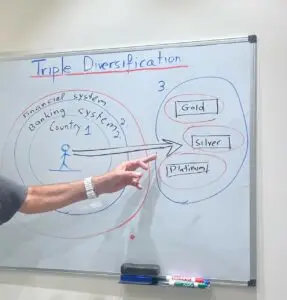

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking

Triple Diversification: Expanding Your Investment Strategy Beyond Borders and Banking In the realm of physical investments, diversifying one’s portfolio is often associated with the acquisition

Electrical Conductivity of Precious Metals

SummaryThis article explores the electrical conductivity of precious metals and their alloys, focusing on its measurement in Siemens per meter and variations across different materials.