“RED TEAM”- Challenging Gold Investments.

An article from 2011 titled “Superstitions, Myths, Folklore and Gold” and written by Michel Levy, the author of the book “Cutting Truths”, challenges some of the basic ideas behind investing in gold and silver.

“Read team” is a common term used in both business, cybersecurity and the military in order to challenge existing assumptions and practices by adopting an adversarial approach. This enables critical thinking and helps with decision-making.

We can use Michal Levy as our “red team” as he presents some of the common conceptions among investors as myths:

Fear has become the reason speculators are driven into buying gold as a safe-haven from apocalyptic disasters. This is fed by a constant stream of expert opinions, with TV anchors and other media reporting their opinions as facts. Most experts today believe in the myths of gold and predict it will continue to be a safe-haven in these uncertain times.

Perhaps they can keep the gold price rising, however, every financial instrument must have a solid foundation to make it stable and secure. Gold cannot be valued beyond the real supply and demand of industrial/jewelry usage, other than the amount of fear-driven speculative trades that causes it to rise.

Here are some of the many myths surrounding gold (and how Michael Levy busts them):

- Gold is a currency … Gold is NOT a currency nor will it ever be. Gold coins are not legal tender and you cannot go into a supermarket and buy groceries with gold dust.

- Gold holds its value in times of war … History has proven gold does not hold its value in times of war. Rather, anyone who held it became a target and was robbed and killed.

- Gold is a protection from recession… This only holds true while it goes up and for as long as the myths can continue to be fired up.

- Gold is over/under valued … This cannot be known as it is worth what people will pay for it.

- Gold is a protection from hyper-inflation… Everything goes up in hyper-inflation, that is why it is called hyper-inflation, and gold may or may not perform any better that any other commodity.

According to Michael Levy, one of the main reasons that gold has performed so well in recent years is due to the ease of trading with ETFs such as GLD.

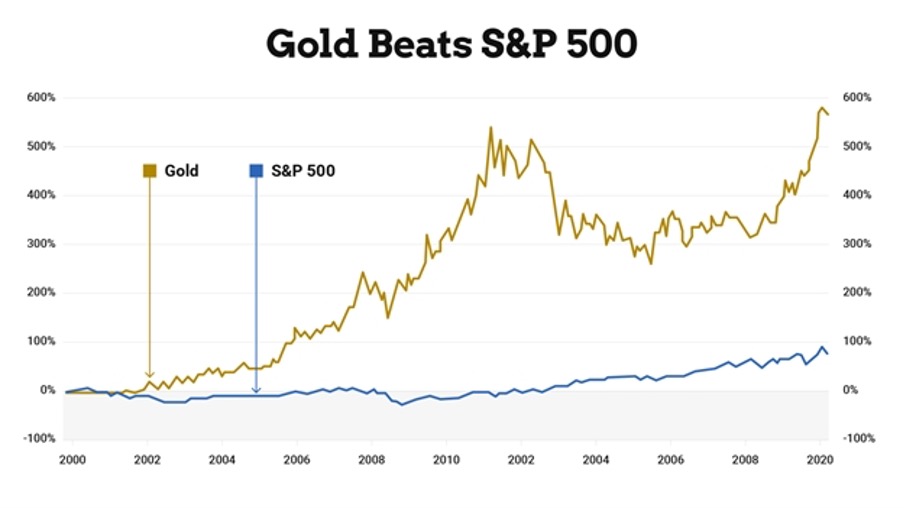

Despite all the so-called myths presented above, the graph below compares the value of investment in gold vs. S&P 500 over the past 20 years, showing that gold was indeed a good investment.

We recommend using the “red team” approach in business and investments as a tool to support decision-making.